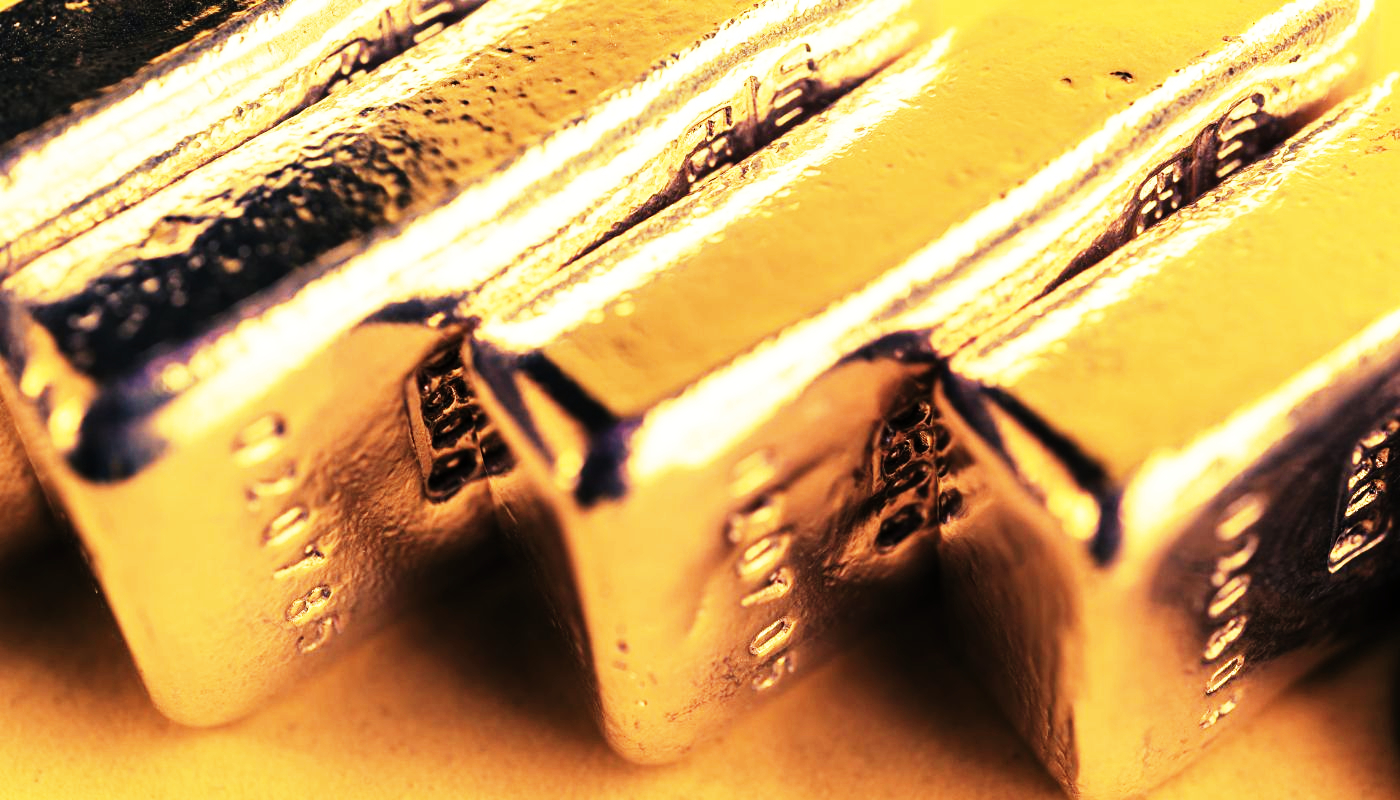

Gold, among the earliest and also most trustworthy investments, still carries substantial weight as a shelter for capitalists during market volatility. Several financiers discover relief in the historical well worth of real gold and also its lengthy background in our economic situation when stocks, bonds, and also various other acquired stores of value fail. Many people saving for retired life are changing their cash into gold IRA fees as a hedge against market unpredictability.

Goldco

In an uncertain international economic market, Goldco can assist clients in diversifying their retired life money right into precious metals IRAs. Whether an individual has a 401( k), a Thrift Savings Plan (TSP), a standard IRA, or a 403( b) strategy, Goldco’s specialists can help them discover how to roll over their possessions right into a gold IRA and also benefit from the safety of gold and various other rare-earth elements.

Goldco likewise makes sure that its investors are knowledgeable on the present market trends and the state of the economic situation by providing comprehensive academic resources. Goldco’s internet site features a wealth of info for its customers, consisting of electronic books, write-ups, as well as video clips on numerous investment-related topics.

American Hartford Gold

American Hartford Gold are simple for the benefit of our clients. Setting up a precious metal IRA, nevertheless, calls for making use of an external depository provider, which comes at an extra expense.

The company will likewise acquire back items as well as will match competitors’ rates. American Hartford’s buy-back program allows consumers to prevent the hassle as well as cost of liquidating their rare-earth elements by purchasing them directly from the business.

Augusta Precious Metals

The company has provided countless financiers with a straight, customer-centric investing experience free of high-pressure sales practices. This business has actually gained its stellar reputation for honesty by setting up an uncomplicated strategy to pricing and also charges.

Augusta promotes itself as “Your Premier Gold IRA Company,” guaranteeing to help its capitalists make sound financial selections prior to retirement. They ensure their consumers understand the subtleties of gold investment and the potential risks included prior to taking any type of money.

Birch Gold

Birch Gold has the two most important qualities for success in any kind of area: extensive experience and understanding. The organization has roughly 20 years of experience in the precious metals market, allowing them to give customers with sound recommendations concerning their financial investments and also retirement.

The web site for Birch flaunts the firm’s expert expertise of the gold market. Birch Gold provides its investors with step-by-step support, real-time interactive charts on the prices of precious metals, and also articles that explore the numerous methods to invest in gold.

Cost to Start a Gold IRA?

The average cost to open a gold IRA is between $100 and also $300. Nonetheless, this does not approach the acquisition, storage, or insurance policy of gold, only the account itself, which commonly varies from $50 to $150. Investors taking into consideration including a gold IRA to their portfolio ought to recognize the many covert prices of this investment automobile.

Gold IRA Setup and Administration Fees

There are no rollover or transfer charges when converting from a traditional IRA to a precious metals IRA. To start the account opening treatment for these self-directed IRAs, rare-earth elements IRAs generally sustain a processing fee from their approved custodians as well as managers. The average cost of this sort of administration is around $50, though this differs commonly from manager to administrator.

Commissions and Markups on Coins

When using a self-directed IRA to get rare-earth elements, there are multiple compensations to take into consideration. There will certainly be purchase fees when you buy or market physical gold coins or bars from your account. Such costs are normally made per event. Commission transaction costs will apply despite the manager you select. They pass on the charges credited them by the bullion or coin dealer with whom they make the deal in your place. The exact quantity varies from manager to manager, but a ballpark figure is $40.

Yearly Maintenance Fees

Your rare-earth elements IRA manager can only manage to benefit a while for the one-time application and also arrangement fee. Sending you declarations frequently as well as monitoring all your holdings. Costs related to maintaining an account expense anything from $75 annually up to several hundred. Watch out for the yearly charge disclosure in the paperwork you receive when you sign up for a totally free info packet or an account. They must be outlined carefully in all needed documents.

Storage Fees

Extra costs will be associated with monitoring and also preserving your vaulted rare-earth elements at the rising depository. The Internal Revenue Service mandates storage of rare-earth elements in these accounts must happen at a secure area aside from the account manager.

Fees are charged annually by depositories like Brinks as well as Delaware Depository to pay these expenses. Your secretary just forwards them to you. The expenses you pay will eventually be figured out by the stockroom you choose.

Miscellaneous Fees

Some extra charges, including cord transfer fees, are likewise frequently inevitable. Most IRA custodians will bill you a fee whenever they send cash to you or a 3rd party (such as a coin/bullion dealer or vault). For every international wire transfer they make on your behalf, you should pay about $25 in cord transfer expenses. These charges must also be listed plainly in the account opening documents.