What Is the Best 401( k) Financial investment?

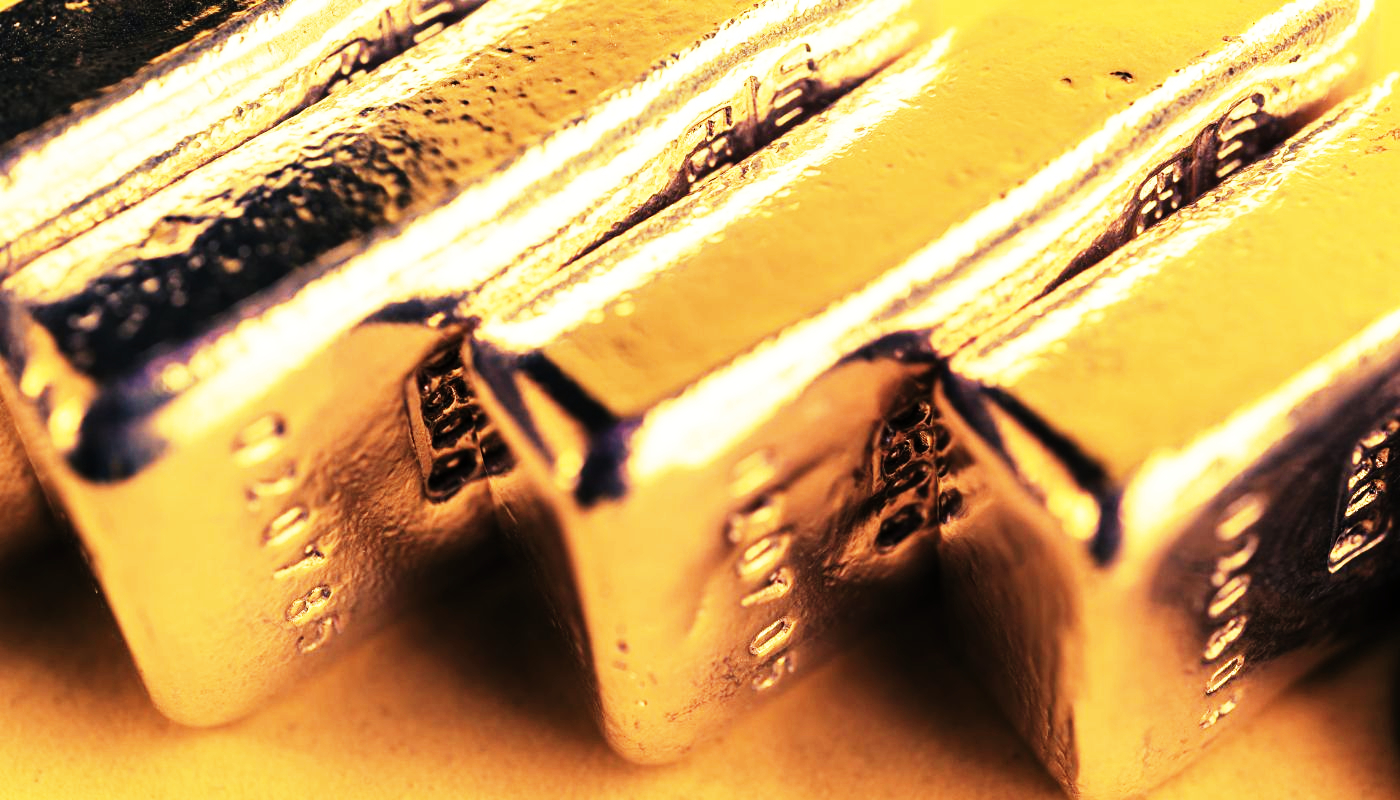

401( k) strategies have actually exceeded pensions as one of the most preferred employer-sponsored retirement in the United States. 401( k) s, unlike pension plans, call for people to pick where their properties are invested. While many convert 401k to precious metals intends deal significantly fewer options than a typical broker agent account, they can however have a significant impact on your financial resources. You ought to pick a fund or funds based on your danger tolerance and also time to retired life.

An economic expert could help you in developing a monetary strategy to satisfy your retirement objectives and objectives.

Target-Date Finances are one kind of 401( k) investment choice.

Target-date funds are very most likely an option, if not the default one, in your 401( k). A target-date fund is a mutual fund that invests in protections depending on the year the investor plans to retire. For instance, if you are 25 years of ages in 2022 as well as purpose to retire around 65, your goal retired life day is 2062. The fund you select could be called “Schwab Target 2062 Fund” or “Integrity Liberty 2062 Fund.”

The funds are based on an essential retired life preparation tenet: the aggression of your profile should be established by how much time you have till retired life. Early in your job, when you’re looking for to boldy increase your nest egg, you need to invest primarily in stocks. As you near retirement therefore have much less time to recoup from a market collapse, you change to a lot more conventional properties.

Consequently, the possession allowance of the fund is identified by how much you are from your preferred old age. And also the allotment changes automatically as the date strategies, so you don’t have to by hand rebalance your portfolio.

Target-date funds are offered in almost every 401( k) plan, and numerous investors favor to buy them instead of establishing their very own portfolio of funds. A target-date fund permits you to expand your investments and select a property appropriation that represents your time horizon. However, you are not needed to carry out any of the task.

There is also no requirement that you pick a fund that is close to your preferred old age. If you’re twenty years far from retirement yet have a high threat resistance, a fund with a longer time perspective might be a much better selection. Therefore, the profile will become more hostile and riskier.

401( k) Financial investment Alternatives: The Do-It-Yourself Strategy

Target-date funds aren’t for every person, as well as some people like to be much more hands-on with their investments. In most cases, you can not purchase certain supplies or bonds through your 401( k). Instead, you can normally choose from a choice of mutual funds and also exchange-traded funds (ETFs). Some will certainly be actively managed, while others will likely be index funds.

So, what types of financial resources and also financial investments can you prepare for?

You can anticipate that large-cap stock funds will be included in almost every system. These are funds consisted of largely of large-cap supplies having a market capitalization more than $10 million. Due to the fact that large-cap equities account for the great majority of the united state equity market, your 401( k) will almost most definitely include numerous funds that invest in them. The Fidelity Large-Cap Stock Fund (FLCSX) and the Lead Mega Cap Value ETF (MGV) are 2 noteworthy large-cap funds.

Mutual fund are another kind of mutual fund that you’re most likely to discover in your 401( k)’s alternative catalogue. A mutual fund is a mutual fund that only invests in bonds. There are different kinds of bond funds in this group, including company mutual fund, government bond funds, short-term mutual fund, intermediate-term bond funds, and long-term bond funds. Mutual fund are prominent due to the fact that, as a whole, they offer the protection of bond investing while being much easier to deal than private bonds. Bonds, however, are not without threat: Climbing rate of interest can hurt longer-term bonds, as well as so-called “scrap” bonds are at danger of default.

You can also rest assured that your method will integrate a worldwide stock fund. This is a mutual fund that buys supplies from firms based outside of the USA. Some, such as the Lead Total Amount International Stock Index (VGTSX), include both established and also emerging market international companies. Others, such as the Fidelity Overall Arising Markets Fund (FTEMX), will certainly purchase simply one or the other. Lots of financial masters may advise you to buy a combination of residential and worldwide firms.

401( k) Fundamentals Investments in a 401( k).

A 401( k) strategy is an employer-sponsored specified payment plan in which you add a percent of your income to an account that grows until you retire as well as begin taking funds. Employers are the just one that use 401( k) strategies. Therefore, if you want accessibility, you need to help a company that funds a plan. A specified payment strategy is so called because you add a specified quantity of money to the fund; you pick just how much to contribute, as much as a specific restriction ($ 22,500 per year in 2023). This is in comparison to a specified advantage plan, such as a pension, where the payment in retirement is predetermined.

Among the best aspects of a 401( k) is that any payments you make are tax-deferred. That is, the cash you divert from your wage goes directly to your 401( k) without going through earnings tax obligation. When you take out the cash in retirement, you should pay earnings taxes on it.

Tax-deferred retirement plans have two primary benefits. Initially, since you are no longer receiving a salary, you might remain in a reduced tax obligation brace in retirement when you should pay these revenue tax obligations. Second, your payments can be deducted from your gross income, lowering your tax obligation obligation.

Some employers will compare to a specific percent of your 401( k) contributions. If your company matches contributions, you need to make every attempt to contribute at the very least that quantity. You’ll lose out on a cost-free increase to your retirement savings if you don’t.