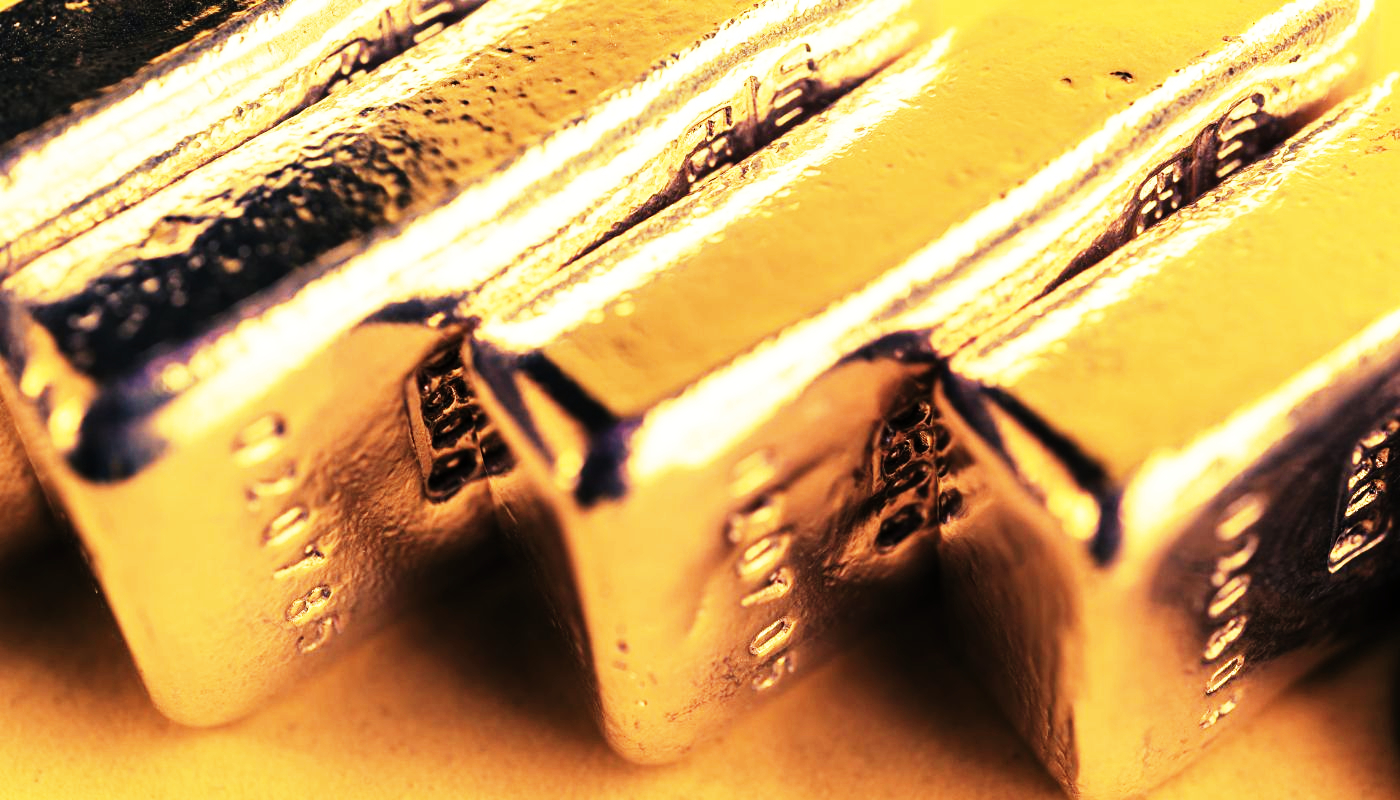

Investing to Precious Metals Ira Companies

Buying a gold IRA is ending up being a progressively prominent way to safeguard your financial future Precious Metals Ira Companies. With the capability to shield your savings from inflation and also market volatility, it’s no wonder that more and more people are counting on this investment alternative. Nonetheless, the gold IRA market is very affordable, as well as with so many business trying your organization, it can be difficult to make an educated decision.

We recognize the significance of choosing the best gold individual retirement account company to trust fund with your hard-earned money. That’s why we have done comprehensive research and evaluation to recognize the most trusted and also trustworthy firms in the sector. We are devoted to supplying our readers with one of the most detailed info and sources to help them make an informed choice as well as choose the best gold individual retirement account company for their requirements.

Why Should you Trust our Evaluation?

Our testimonial is designed to offer you with trustworthy and also credible details, to help you make notified choices when choosing the ideal gold IRA firm. Our team of specialists has evaluated as well as assessed a selection of one of the most respectable companies in the sector, making use of data-driven approaches to fairly evaluate each product and also its solutions. We are devoted to supplying impartial as well as impartial insights, guaranteeing that our viewers have the very best feasible chance of locating the right retirement account to match their profile needs.

Exactly how to Choose a Gold Individual Retirement Account Business

Prioritizing your demands and preferences is very important when selecting a gold IRA supplier. You will certainly be able to discover a gold IRA business that is aligned with your investment purposes and also satisfies your requirements.

Consider the informative sources provided by the firm. You should also assess the access and also top quality of academic materials as well as the site. You require to be able to accessibility comprehensive details in order to make an informed decision concerning your financial investments. You ought to likewise take note of exactly how responsive the customer support is, and also any type of rewards or promos that the firm may supply, considering that these can reduce your charges.

A company’s level of depend on with consumers in its industry is another crucial aspect to think about. You can gather details concerning a business by reviewing consumer testimonials.

It is critical to very carefully research study as well as examine gold IRA business in order to figure out which one finest matches your investment requirements. You can be positive in your choice to select a gold IRA company if you thoroughly think about these factors.

FAQs

What Is a Gold individual retirement account

Gold IRAs are a type individual retirement accounts (Individual retirement accounts) that allow you to invest in precious metals such as gold, platinum, palladium as well as silver in the kind bullions, bars as well as coins. A gold IRA is various from conventional IRAs where you can purchase stocks, bond and other monetary assets. Rather, you possess physical gold that’s stored in a risk-free, IRS-approved center. For your gold individual retirement account to preserve its tax-advantaged standing, you will certainly need a custodian that can manage your financial investment, along with fulfill IRS reporting, record-keeping and also storage space demands.

Is gold Individual retirement accounts an exceptional concept?

Gold IRAs are taken into consideration by many financial experts to be an excellent investment technique as they offer a hedge versus rising cost of living. Gold has always held its worth, giving your retired life profile a complacency and stability.

What is the expense of starting a gold IRA?

Prices for beginning a Gold individual retirement account differ relying on which precious metals IRA supplier you pick. Some business have greater costs or minimum financial investment demands. Compare the expenses of various business to figure out which is best for you.

What is a Gold individual retirement account?

The gold individual retirement account transforms your standard IRA to a precious-metals individual retirement account This enables you to invest in gold and various other precious-metals. The individual retirement account custodian takes care of the storage and also management of gold assets as well as will certainly offer you with records about the efficiency and also value of your financial investment.

Can Gold be Kept In an individual retirement account?

Gold can not be kept in an individual retirement account. Gold as well as other valuable products have to be kept in a depository approved by the internal revenue service, which is taken care of by a precious-metals IRA custodian. IRS regulations permit you to watch photos as well as obtain updates concerning your gold. Nevertheless, physical ownership of the gold is not allowed.

Which Gold Individual Retirement Account Business Is The Best?

Your specific objectives and also needs will establish the best gold IRA carrier for you. Take into consideration the charges charged by the business, its client service, the academic sources it supplies, as well as the credibility of the company in the industry. Contrast as well as research various firms in order to locate one that fits your demands.

What is the Advantage and Also Disadvantage Of A Gold Ira.

Pros:

- Gold IRAs are an excellent way to secure your retirement cost savings from rising cost of living and financial instability.

- Physical gold provides better security and also security than supplies as well as bonds.

- Gold IRAs offer the same tax benefits as traditional IRAs. These consist of tax-deferred gains and tax cost savings.

Cons:

- Gold IRAs are a lot more expensive than typical IRAs as a result of greater fees for storage, arrangement and also upkeep.

- Physical gold can be an unpredictable investment, as its price is a lot more susceptible to fluctuations in market problems.

- The gold individual retirement account can be less liquid than some other investments. This makes it harder to get your money in a timely style.

- What is the most effective total up to purchase a Gold individual retirement account?

- Your financial investment objectives and your resistance for threat will certainly determine the quantity of cash you should buy a Gold IRA. Some financial experts suggest spending between 5% and also 15% of your overall profile in gold. The precise quantity depends upon your personal situations.

What are the Taxes of A Gold Individual Retirement Account?

Gold IRAs have the same tax obligation treatment as standard IRAs. This indicates that they can supply tax-deferred gains and also cost savings on withdrawals as well as payments. There may be additional constraints and policies on exactly how you can access your gold.